C-Suite Insights + Industry Experts

We’ll be the first to admit in healthcare that we don’t have it all figured out. But what we do know, we’d like to share.

Please SCROLL DOWN + LEFT TO RIGHT to view multiple quotations and perspectives from experts helping Doctors over the years, PLUS a list of industry resources — Bonus: You’ll also find CMT legal contributing writers (2025) commentary and their thoughtful, outside the box considerations FOR DOCTORS about topics such as marketing, Medicare, compliance and more! (See below)

FOUR BRAND NEW LEGAL DISCUSSIONS

Updated for 2025-2026!

🎙️Cash Healthcare: How Does It Really Work??? Industry Legal Expert 🎙️ Weighs In!

Today our guest is an attorney and an old friend! You probably know him, Jim Eischen, Esq. He’s a talented musician, a motorcycle rider … and more importantly FOR Doctors today, Jim’s an expert in cash healthcare and compliance.

Legal Considerations 🎙️ Concierge Medicine is Creating a Splash from the Windy City 💨 to the Sunshine ☀️😎 State: But Remember, It’s Not a One-Size-Fits-All Solution!

Jonna D. Eimer is a health law and corporate attorney and shareholder at Roetzel & Andress in Chicago, Illinois. She represents numerous concierge medicine practices and has extensive experience with other innovative practice models. She also advises her clients – including physicians and physician groups, dentists, behavioral health clinicians, and other health care providers – in forming new practices, selling established practices, and negotiating employment and shareholder agreements, as well as guiding them with respect to regulatory matters.

© 2007-2025 Concierge Medicine Today, LLC. All rights reserved. CONCIERGE MEDICINE TODAY IS THE INDUSTRY’S TRADE PUBLICATION, EST. 2007. DISCLAIMER: THIS SITE DOES NOT CONSTITUTE MEDICAL, FINANCIAL, LEGAL OR OTHER PROFESSIONAL ADVICE. © 2025 CONCIERGE MEDICINE TODAY, LLC. ALL RIGHTS RESERVED. THIS CONTENT/SITE IS NOT WITHOUT ERROR OR OMISSIONS.

Why Are There So Many Concierge Medicine Practice Transactions?

Most physician owners of concierge medicine practices do not have experience going through a practice sale or major partnership transaction — here are some helpful and practical recommendations to consider.

FOURTH OIG ALERT: RPM and CASH HEALTHCARE IN AMERICA — 2025-2026 IMPACT ON MEDICAL OFFICES

Jim Eischen, Esq. is recognized nationally for compliance experience regarding complex corporate business planning and transactions. As a speaker at conferences throughout the US, he addresses data privacy, regulatory business planning problem-solving, and start-up innovation monetization.

Industry Specific Resources (Listed In Alphabetical Order)*

The content is for general information aimed at a healthcare audience and is not an endorsement of any mentioned entities. This site may contain errors and does not offer medical, financial, or legal advice. CMT is not liable for inaccuracies and users should consult trusted advisors before acting on the information. Users assume all risks and should conduct their own research. By using CMT's platforms, users agree to the Terms and Conditions of Use and Privacy Policy.

About the Athenic Group

Areas of Expertise Include:

Our recruitment services division functions as a boutique search firm specializing in physician and provider recruitment. We use the same resources large retained firms’ use, but we take a more tailored and personal approach. Our founder, Craig Fowler, is a nearly 25 year veteran of the physician recruiting industry; including holding senior leadership roles with several of the largest retained physician recruiting firms in the country. He is a former President of the National Association of Physician Recruiters (NAPR) and is a sought after speaker and trainer on physician recruitment processes and trends.

About Castle Connolly Private Health Partners

Areas of Expertise Include:

Castle Connolly Private Health Partners, LLC (CCPHP) works with exceptional physicians to create and support concierge (membership-based) healthcare programs that enable the optimal practice environment and the physician-patient relationship. Members (patients) pay an affordable fee to take advantage of a wide array of enhancements for a more convenient, comprehensive, collaborative, and personalized approach to support health and wellbeing.

Learn more about Castle Connolly Private Health Partners, LLC at ccphp.net

About Cinnamon Hill Partners, LLC

Areas of Expertise Include:

In today's evolving healthcare landscape, the decision to sell a medical practice is often driven by various factors, including retirement planning, changing market dynamics, and the desire for a better work-life balance. However, selling a practice is more than finding a buyer and closing a deal. It involves meticulous preparation, accurate valuation, strategic negotiation, and careful transition management. For healthcare entrepreneurs, understanding these components is crucial to maximizing the value of their practice and ensuring a smooth transition for both patients and staff. Before we delve into the topic, I want to be completely transparent about my perspective. I am the founder of a search fund and have dedicated my career to buying a single exceptional business from a willing seller. This blog is written from the perspective of an aspiring buyer, but my goal is to offer honest and fair advice to readers based on my experience, the experience of my seasoned investor group, and the numerous cited sources from experts within this blog post. Some of you may be potential business owners, and I have directed you to this blog post to provide education before we begin a possible sale process. To all the readers of this blog post, I hope you find this blog informative and helpful.

Connect with Justin Outslay, Founder - justin@cinnamon-hill.com

About Concierge Choice Physicians (CCP)

Dedicated to providing real options for patients and physicians, Concierge Choice Physicians™ is the largest private provider of the full range of concierge programs available today—Hybrid and FullFlex™. For nearly 20 years, the company provides innovative, flexible and affordable models proven to work in medical practices of any size—from solo physicians to large medical practice corporations—both independent and affiliated with hospitals or health systems. Headquartered in Rockville Centre, NY, the company has worked with over 500 physicians in 29 states.

For more information, please visit www.choice.md

About ECG Management Consultants

“Healthcare providers are currently navigating through a period of radical industry change. The ability to identify best practices, both within the health sector and externally in other industries, is critical for providers to maintain competitive advantages in dynamic markets. Having the opportunity with ECG Management Consultants to add value to those organizations providing essential care services to our community is extremely rewarding to me.”

Alex Muckerman, Senior Manager, amuckerman@ecgmc.com - https://www.ecgmc.com/about/team/amuckerman/3

Jonna D. Eimer at Roetzel & Andress in Chicago, Illinois.

Jonna D. Eimer is a health law and corporate attorney and shareholder at Roetzel & Andress in Chicago, Illinois. She represents numerous concierge medicine practices and has extensive experience with other innovative practice models. She also advises her clients – including physicians and physician groups, dentists, behavioral health clinicians, and other health care providers – in forming new practices, selling established practices, and negotiating employment and shareholder agreements, as well as guiding them with respect to regulatory matters. In addition, she counsels clients in forming management services organizations (MSOs) and navigating these sales to private equity.

Learn More, visit: https://www.ralaw.com/people/jonna-eimer

About Eischen Law Offices

James Eischen, Esq (Jim Eischen) is a licensed California attorney with over 32 years of experience handling complex corporate, business planning, health care and real estate matters. We at Eischen Law Office know that finding the right attorney to represent you is a choice not to be taken lightly. That’s why we offer free consultations to walk you through your needs, the scope of your goals, and your budget.

Learn More, visit https://www.eischenlawoffice.com/

About Michele P. Madison

Michele P. Madison has significant experience in managing legal issues arising in hospitals, physician offices or integrated health systems, including employment, investigations, risk management assessment and corporation management. She provides legal education for health systems’ medical staff, management teams and employees and often facilitates and manages implementation of compliance plans for HIPAA privacy and security regulations. In addition, Michele drafts and completes Certificate of Need applications and facilitates regulatory compliance, and provides oversight and guidance regarding medical staff governance and credentialing issues.

Learn More, visit: https://www.bradley.com/people/m/madison-michele-p

About Ms.Medicine

Ms.Medicine is female-founded and focused on building an integrated healthcare network of concierge women’s health-trained physicians and practitioners across the US, providing high-quality expert women’s healthcare for those who want the best. Until now, women have lacked exposure to what they are missing in their medical experiences. We work to empower patients by connecting them with expert providers who have advanced knowledge in neglected areas: menopause, sexual health, breast cancer risk, heart health, bone health, pelvic floor conditions, genetics, cancer survivorship, and sleep + nutrition.

Learn more at: https://www.msmedicine.com/about-us

About MD²® (MD SQUARED®)

MD2 (pronounced “MD Squared”) is largely credited for pioneering a style of healthcare that would later be called “concierge medicine.” Dr. Howard Maron founded MD²® (MD SQUARED®) in 1996 based on the belief that delivering exceptional medical care must fundamentally revolve around, honor and protect the most sacred of relationships – that between a physician and a patient. This is only possible when you limit your patient threshold to so few; 50 select families, cared for by 1 exceptional physician who is committed to elevating their craft of medicine. This is a vow we are honored to uphold.

Learn More at https://www.md2.com

About MDVIP

MDVIP leads the market in membership-based healthcare that goes far beyond concierge medicine services with a national network of approximately 1,100 primary care physicians serving 362,000 patients. MDVIP-affiliated physicians limit the size of their practices, which affords them the time needed to provide patients with more individualized service and attention, including an annual, comprehensive preventive care program and customized wellness plan. Published research shows that the MDVIP model identifies more patients at risk for cardiovascular disease, delivers more preventive health services and saves the healthcare system hundreds of millions of dollars through reduced hospitalizations and readmissions. In response to growing consumer demand for a more personalized healthcare experience, hospital systems are incorporating the MDVIP model into their primary care offering. MDVIP is also partnering with employers to offer an executive health program as a benefit to their employees. The company, which celebrated its 20th anniversary last year, has been certified by Great Place to Work since 2018 and is recognized by Fortune as one of the 2021 Best Workplaces in Healthcare.

For more information, visit www.mdvip.com or follow on LinkedIn.

About PartnerMD

For physicians, we enable you to practice medicine how you've always wanted.

As a concierge doctor at PartnerMD, you can practice medicine the way you envisioned it coming out of medical school.

Instead of rushing through 20+ patients per day, you see 6-10.

You spend at least 30 minutes with every patient instead of at most 10.

You see patients when they need you the most, instead of pushing them to urgent care.

The result is more personal care for your patients, and a more fulfilling experience for you as a doctor.

Learn more about PartnerMD at: https://www.partnermd.com/about

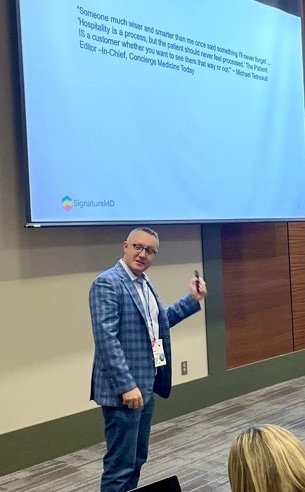

About SignatureMD

SignatureMD is one of the nation's largest providers of initial conversion and ongoing support services to concierge medicine physicians, with an expanding network of over 200 affiliated primary care physicians and specialists across 35 states.

To learn more about SignatureMD's flexible models for concierge care, visit www.signaturemd.com.

About Specialdocs Consultants

Specialdocs Consultants provides consulting and professional services for physicians who are transitioning their practice from the traditional model to the concierge or membership model. Specialdocs provides ongoing support for practices before, during and after the transition. Established 2002, Specialdocs Consultants has transitioned physicians across the United States. Headquartered in Highland Park, IL.

For more information, please visit https://specialdocs.com/

About WellcomeMD

The goal of concierge medicine, or what we like to call membership medicine, is to re-establish the kind of personal relationship with your primary care physician that once prevailed in American communities. We call our model “Concierge 2.0” - because our physicians see half the number of patients per doctor as many other concierge practices while accessing new, cutting-edge treatments.

Learn more about WellcomeMD at: https://www.wellcomemd.com/

LEGAL EXPERTS’ COMMENTARY AND THOUGHTFUL CONSIDERATIONS FOR DOCTORS

Commentary Credits and Disclaimers

(Alphabetical; Please See Below; Disclaimers, These are not endorsements, nor legal advice. The content is for general information aimed at a healthcare audience and is not an endorsement of any mentioned entities. This site and the opinions expressed are not necessarily the opinions of Concierge Medicine Today (CMT). Please do your due diligence before acting on what you learn, read of find on this web site. This content may contain errors and CMT does not offer medical, financial, or legal advice. CMT is not liable for inaccuracies and users should consult trusted advisors before acting on the information. Users assume all risks and should conduct their own research. By using CMT's platforms, users agree to the Terms and Conditions of Use and Privacy Policy.

Jonna D. Eimer at Roetzel & Andress in Chicago, Illinois.

Jonna D. Eimer is a health law and corporate attorney and shareholder at Roetzel & Andress in Chicago, Illinois. She represents numerous concierge medicine practices and has extensive experience with other innovative practice models. She also advises her clients – including physicians and physician groups, dentists, behavioral health clinicians, and other health care providers – in forming new practices, selling established practices, and negotiating employment and shareholder agreements, as well as guiding them with respect to regulatory matters. In addition, she counsels clients in forming management services organizations (MSOs) and navigating these sales to private equity. Learn More, visit: https://www.ralaw.com/people/jonna-eimer

About Eischen Law Offices

James Eischen, Esq (Jim Eischen) is a licensed California attorney with over 32 years of experience handling complex corporate, business planning, health care and real estate matters. We at Eischen Law Office know that finding the right attorney to represent you is a choice not to be taken lightly. That’s why we offer free consultations to walk you through your needs, the scope of your goals, and your budget. Learn More, visit https://www.eischenlawoffice.com/

Michele P. Madisone has significant experience in managing legal issues arising in hospitals, physician offices or integrated health systems, including employment, investigations, risk management assessment and corporation management. She provides legal education for health systems’ medical staff, management teams and employees and often facilitates and manages implementation of compliance plans for HIPAA privacy and security regulations. In addition, Michele drafts and completes Certificate of Need applications and facilitates regulatory compliance, and provides oversight and guidance regarding medical staff governance and credentialing issues.

WAXMAN LETTER (circa 2002)

Attached is the March 2002 letter from Congressman Waxman we discussed earlier regarding the Tommy Thompson letter search. Thompson’s reply on behalf of HHS should have followed in March or April 2002. Reading the full exchange, the takeaway is clear: in 2002, HHS essentially signaled that the typical concierge practice model was Medicare compliant.

Source/Credit:

Concierge Medicine Today, LLC. Documents provided from public record via the Tommy G. Thompson Collection, Marquette University Archives. Includes Congressman Waxman’s March 2002 letter and Secretary Tommy G. Thompson’s official response (file noted as “Last Revision”).

Cost Sharing/Expenses

“Another issue confronting concierge practices is cost sharing and how to divide expenses in this type of practice models. Practices must decide if they are allocating costs based on each physician’s patient panel size or based on their respective ownership percentages of the practice. Once you allow for different panel sizes, these differences can become quite problematic, and physicians can end up disagreeing on the fair allocation of these costs. Confronting these differences early in the formation of the practice and providing for them in the practice’s operating documents can help avoid difficult and costly conflicts later for the partners.” (Eimer; 2025)

Medicare/Medicaid/HMO COMPLIANCE

“Collaborate with a knowledgeable attorney, consultant, or individual(s) to structure your cash practice to follow three (3) federal statutes and decades of Medicare/OIG guidance (essentially, using what looks like the executive health model but with different branding and added/variable features). This approach ensures Medicare/Medicaid/HMO compliance, allows for healthcare insurance plan integration (if desired, and not necessary), and ensures patient fees are “qualified medical expenses” eligible for HSA/FSA/HRA/MSA funding (in other words, allows for employer and pre-tax funding) with no changes in existing laws—it works right now.” (Eischen; 2025)

Coverage and Licensing Concerns

“Because of the unique access provided to concierge patients, some practices have added special coverage when these patients are out of state or on vacation. In light of their patients who winter in warmer climates, like Florida, California and Arizona, some practices have partnered with other concierge practices in these states to offer services to their “snowbird” patients. Health systems are taking advantage of these practice models also. For instance, Chicago-based Northwestern Medicine opened a concierge medicine office in Naples, Florida, and Ohio-based Cleveland Clinic also has opened concierge medicine practices in multiple Florida locations. Doctors, however, need to be aware that they need to be licensed in the state where the patient resides. Due to these licensing considerations, some concierge physicians are also obtaining licenses in other states to cover patients that often spend their winters in these warmer states.” (Eimer; 2025)

BE UNIQUE, AVOID INDUSTRY JARGON

“Steer clear of marketing and branding, that, while quite prevalent in the marketplace, is frustrating your patient fees achieving qualified medical expense status. For example, you may dearly love the DPC or concierge [as terms or] brands, but, the IRS is convinced that neither brand’s patient fees are qualified medical expenses. Why debate the IRS? Neither brand is likely to fully explain YOUR medical or healthcare philosophy, and neither brand assists with qualified medical expense status so both brands frustrate HSA/FSA/HRA/MSA funding absent changes in tax laws and IRS regulations.” (Eischen; 2025)

Transitions, Terminations and Retirement

“The concierge model generally relies on increased access and time for patients because physicians have typically accepted fewer patients. Because of this, it can be very difficult to figure out the fairest way to negotiate a partner’s exit and how these patients and fees paid would transfer in the event of such departure. Does the partner get paid only in a buy-out of the whole practice or will the practice buy-out the individual partner upon his or her termination? Would this be handled differently in the case of a retirement? Would the practice consider a buy-out only if another physician can be substituted and take over the patient panel? How then is the new provider paid if fees have already been collected for a given year? It is possible the patients reject the substitute physician regardless of the departing physician’s recommendation.” (Eimer; 2025)

“Oftentimes, the agreements governing the practice’s operations include long notice provisions prior to any termination or retirement because it is not easy to substitute another concierge doctor if one leaves. Also, the patients have paid for the personal relationship and membership with their own doctor, so they do not always feel that this relationship transfers to another doctor. Another thing to consider is if a doctor terminates or unexpectedly dies or becomes disabled and a new doctor cannot cover their patients, what happens to patient fees that have already been collected? The practice needs to consider whether these fees are returned to patients and then whether a new membership agreement is entered into with the new physician. All these considerations need to be addressed in the initial stages of the company’s operations.” (Eimer; 2025)

DON’T ALWAYS FOLLOW THE CROWD

“If your attorney or consultant tells you to opt out of Medicare to do cash healthcare — you are not working with the right expert. Opting out creates different but real compliance risk that the person you are working with does not understand.”(Eischen; 2025)

Don’t replicate, innovate.

“Avoid formulas, brands, and models that work against you implementing your unique vision of healthcare. Don’t replicate, innovate. And, do so using the referenced structuring that for decades has achieved Medicare compliance and tax-advantaged funding options. Call the practice whatever you want, incorporate whatever healthcare services you wish into your subscription, and don’t be constrained by the ill-informed guidance in this marketplace that is not using existing laws/guidance to maximize your practice’s potential.” (Eischen; 2025)

“Because each concierge practice has unique patient fee agreements to consider, there is not a “one size fits all” approach to advising these practices. Concierge practices should not overlook the unique legal and practice issues facing them, from patient fee issues to physician departures. These models have a variety of legal challenges that should be addressed at the early stages of the practice, so they do not lead to partner and patient discord later on.” (Eimer; 2025)

Don’t let Guilt Drive Your Strategy, You’re Worth More Than You Think You Are.

“Instead of allowing a combination of guilt and lack of accurate pricing market data to cause you to under-price and devalue your brand, consider instead pricing your practice at true market value but using ad hoc scholarships/discounts and employer funding to improve equitable access to cash healthcare.” (Eischen; 2025)

Regulatory Considerations

“Concierge practices typically charge a fee for membership in their practice, which generally allows patients increased access to the physicians and their services. If the practice is accepting Medicare and/or commercial insurance, the fee cannot be charged for any service already covered by Medicare or insurance. Additionally, if the practice accepts commercial insurance, the fee must be scrutinized to be sure it is allowed under any agreement with a commercial payor of the practice. Some payor agreements may specifically prohibit any patient fee for membership in a practice. Some practices have reached out to their commercial payors directly when converting to a concierge practice and have had these commercial payors review and approve their patient agreements and membership fees.” (Eimer; 2025)

When you have a heart for your community, you don’t have to compete on price.

“Consider your practice pricing as establishing your perceived brand value in the marketplace. You need not track the national franchise-style concierge enterprise pricing or DPC pricing: both are frequently published, but, most cash practices do not market their prices—so the actual market is much higher than your online search reveals. So the easiest prices to find are not necessarily reflective of the actual market, and imitating them will devalue your perceived brand. Instead, work with an experienced attorney or consultant who actually knows the unpublished typical prices for cash practice models. And remember, most if not all of those published price versions of cash healthcare are not structuring their fees/services to allow for employer/tax-advantaged funding, and perhaps their lower prices are unintentionally reflecting that. Pre-tax and employer funding options allow for higher prices points, and can be used to provide versions of this care with 100% employer funding—that can enable more folks to benefit from this care model.” (Eischen; 2025)

Sales to Third Parties

“Physician owners in a concierge practice also need to consider at the formation of a practice how the profits of the practice will be divided in the case of a sale to a third party. Will profits be divided based on a physician’s ownership in the practice or based on an individual physician’s production and fee generation? If a practice has providers with vastly different production and patient panel sizes, then this is important to consider because the higher producing partner may want a sale to a third party to take into account these differences. Another partner may feel strongly that profits should be divided based on ownership percentages in the practice entity, which may be equal even if the providers have different numbers of patients. Frequently, the potential buyer has their own considerations for valuing the practices and may ascribe different values to each physician’s practice. The buyer may base its valuation of the practice on patient panel size and fees generated by each individual physician.” (Eimer; 2025)

you have options without creating compliance risks.

“If your attorney or consultant tells you that you cannot bill insurance or stay in network while doing cash heallthcare— you are not working with the right expert. There is a wide range of preference with plan billing in cash healthcare. The right expert can explain to you that you can elect to bill plans a little, a lot, or not at all, and why you have those options without creating compliance risks. You can do zero plan billing, or some, but you should know why you have those options, and why there is no need to opt out of Medicare.” (Eischen; 2025)